Introduction: Understanding the Path After a Loved One’s Passing

A probate administration attorney is a legal professional who guides executors and families through the court-supervised process of settling a deceased person’s estate, including validating wills, paying debts, and distributing assets to heirs.

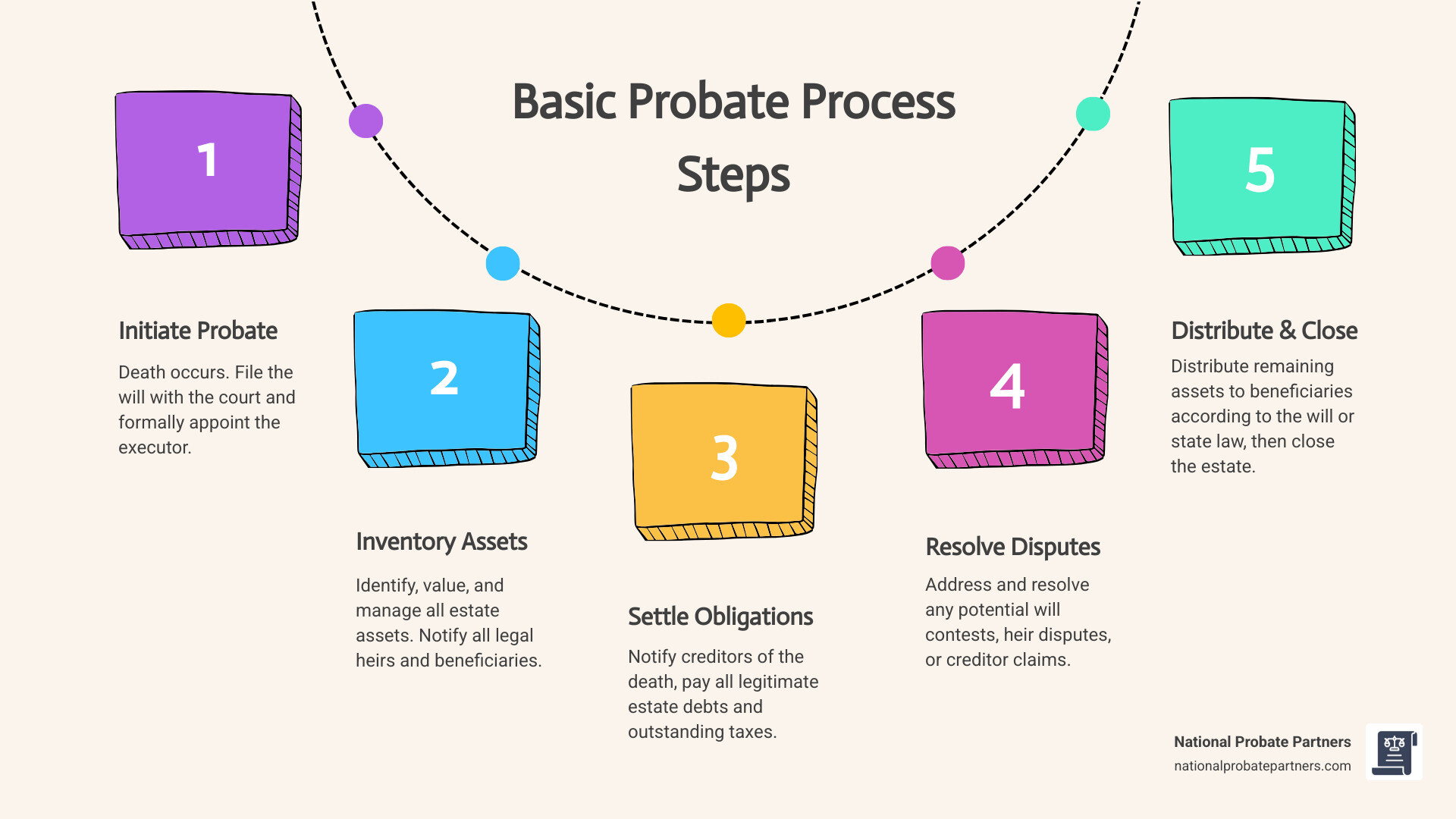

What a Probate Administration Attorney Does:

- Validates the will in court and proves its legal authenticity

- Files necessary court documents to open the probate case

- Identifies and notifies heirs and beneficiaries of their rights

- Inventories and manages estate assets during the probate process

- Pays outstanding debts and taxes from the estate

- Resolves disputes among heirs or challenges to the will

- Distributes remaining assets according to the will or state law

- Closes the estate with final court approval

When someone dies, their property doesn’t automatically transfer to loved ones. The law requires a formal process called probate to ensure debts are paid and assets reach the right people.

This process can be overwhelming, especially while grieving. You face confusing legal forms, court deadlines, and potential family disputes. Even straightforward cases can take at least six months to resolve.

A single missed deadline or filing error can lead to personal liability for the executor and costly delays. A probate administration attorney provides essential legal expertise and peace of mind during this difficult time.

The Core Responsibilities of a Probate Attorney

When a loved one passes away, the legal and financial tasks that follow can feel like navigating a labyrinth. A skilled probate administration attorney illuminates the path, ensuring the estate administration process is handled with precision, care, and legal compliance. We guide executors and personal representatives through every step, from initial court filings to the final distribution of assets.

What are the Main Responsibilities of a Probate Administration Attorney?

Our primary role is to act as a knowledgeable advocate throughout the probate journey. Key duties include:

- Initiating the Court Process: We prepare and file the necessary petition with the probate court to formally begin the process. This includes validating the will and obtaining “Letters Testamentary” or “Letters of Administration,” which empower the personal representative to act on the estate’s behalf.

- Managing Estate Assets and Liabilities: We assist the personal representative in locating, inventorying, and appraising all estate assets. A critical part of this is identifying legitimate creditors, paying valid debts and taxes, and managing assets responsibly throughout the process.

- Ensuring Legal and Fiduciary Compliance: We handle all court filings and ensure every step complies with strict state-specific laws and deadlines in Arizona or Texas. We also guide the personal representative on their “fiduciary duty” to act in the estate’s best interests, helping them avoid personal liability.

- Communicating with Heirs and Beneficiaries: We identify all legal heirs, ensure they receive proper notification, and often serve as a central point of contact to keep them informed of the estate’s progress.

- Final Distribution and Estate Closure: Once all debts and taxes are settled, we prepare the final accounting and distribution plan. We ensure assets are correctly transferred to the rightful heirs before formally closing the estate with the court.

Navigating Will Contests and Heir Disputes

Disputes over a will can significantly prolong the probate process. Common challenges include allegations of undue influence, lack of capacity, or fraud. As probate administration attorneys, we skillfully manage these challenges, whether through mediation or litigation. We first explore amicable solutions like mediation to preserve family relationships. If that fails, we provide robust litigation support to defend the will’s validity or resolve heir disputes, always aiming to protect the estate’s integrity. You can learn more about managing these challenging situations with our insights on More info about probate disputes.

Decoding the Probate Process: Timelines and Types

The probate process is rarely a quick sprint; it’s a marathon with a timeline that varies based on the estate’s complexity. Understanding the different types of probate can help manage expectations.

Different Types of Probate Proceedings

The type of proceeding depends on the estate’s size and whether there is a valid will.

- Formal Administration: The most common type, required for larger or more complex estates. It involves extensive court supervision and is the standard for most probates in Arizona and Texas.

- Informal Administration: Available in some states for simpler, uncontested estates, this process involves less court oversight and can be faster.

- Summary Administration: A simplified process for very small estates that meet specific value thresholds (e.g., under $75,000 in Texas, excluding certain property, via a “Small Estate Affidavit”).

- Uncontested vs. Contested Probate: An uncontested probate is smooth, with all parties in agreement. A contested probate involves disputes that significantly increase time, cost, and complexity.

In Texas, we also handle specific procedures like:

- Muniment of Title: A simplified process to transfer property title when there is a will and no unpaid debts.

- Determination of Heirship: A court proceeding to legally identify heirs when a person dies without a will (intestate).

What is the Typical Timeline for Probate?

No two cases are identical, but a general timeline helps set expectations. Even simple cases often take at least six months, while complex or contested estates can span years.

- Initial Filing and Executor Appointment (1-2 months): Filing the petition and having the court appoint the personal representative.

- Creditor Notice Period (3-6 months): A statutory period is required for creditors to file claims against the estate.

- Asset Management and Tax Filing (6-12 months): The personal representative inventories assets, manages finances, and files necessary tax returns.

- Final Distribution and Closing (9-18+ months): After all debts and claims are settled, a final accounting is approved by the court, and assets are distributed to beneficiaries before the estate is formally closed.

We provide transparency throughout this process, keeping you informed of milestones and potential delays. For general information, you can refer to a Guide to wills, estates, and probate court (Note: This is a general guide and not specific to Arizona or Texas law).

Probate vs. Non-Probate: What’s in the Estate?

Understanding the difference between probate and non-probate assets is fundamental to estate administration. Not all property must go through the court-supervised probate process. Probate assets are those controlled by the will (or state law if there’s no will) and require court oversight to transfer ownership. Non-probate assets have a built-in mechanism for transfer that operates outside the court system.

Understanding Non-Probate Assets

Non-probate assets transfer directly to a designated beneficiary or co-owner upon death, bypassing the probate court. This can significantly streamline estate settlement. Common examples include:

- Assets with Beneficiary Designations: Life insurance policies, retirement accounts (IRAs, 401(k)s), and annuities pay out directly to the named beneficiary.

- Jointly Owned Property with Right of Survivorship: Real estate or bank accounts owned as “joint tenants with right of survivorship” automatically pass to the surviving owner.

- Payable-on-Death (POD) and Transfer-on-Death (TOD) Accounts: Bank or investment accounts that transfer automatically to a named beneficiary.

- Assets in a Living Trust: Property titled in the name of a living trust is managed and distributed by a trustee according to the trust’s terms, avoiding probate.

How Probate Differs from Estate Planning

Estate planning is the proactive process of preparing for the future, while probate is the reactive process that occurs after death. A good estate plan can simplify or even avoid probate.

| Feature | Estate Planning | Probate Administration |

|---|---|---|

| Timing | Proactive: Done during a person’s lifetime | Reactive: Occurs after a person’s death |

| Goal | To control asset distribution, minimize taxes, avoid probate, and plan for incapacity | To legally transfer assets, pay debts, validate wills, and settle the estate |

| Key Documents | Wills, trusts, powers of attorney, advance directives | Will (if one exists), death certificate, court petitions, inventory, final accountings |

| Process | Creating legal documents and strategies | Court-supervised process of validating, collecting, paying, and distributing |

| Focus | Future planning, personal wishes, asset protection | Legal compliance, debt settlement, asset transfer |

| Involvement | The individual planning their estate | Personal representative (executor/administrator) and beneficiaries |

We specialize in both guiding families through probate and helping individuals create robust estate plans to protect their loved ones from future complexities. For more insights, explore The Ultimate Probate Lawyer FAQ 2025 Edition | National Probate Partners.

Special Circumstances a Probate Attorney Can Handle

Our expertise extends beyond standard estate administration to a range of special circumstances that add layers of complexity and require specialized legal knowledge.

How a Probate Administration Attorney Handles Intestate Succession

When a person dies “intestate” (without a valid will), state law dictates how their estate is distributed. This makes legal guidance critical. In these cases, we:

- Identify Legal Heirs: We use state intestacy laws to determine the rightful heirs, which can be complex in cases involving blended families or unknown relatives.

- Appoint an Administrator: Since there is no will naming an executor, we help eligible family members petition the court to be appointed as the estate’s administrator.

- Oversee Asset Distribution: We ensure assets are distributed according to the legal hierarchy established by state law, preventing disputes and ensuring compliance.

Assisting with Guardianship and Conservatorship

Probate courts also oversee the care of minors and incapacitated adults. Our attorneys can assist with:

- Guardianship for Minors: If a minor inherits property, a guardianship may be needed to manage those assets until they reach adulthood. We help petition the court and establish the guardian’s responsibilities to protect the child’s inheritance.

- Conservatorship for Incapacitated Adults: When an adult can no longer manage their own financial or personal affairs, a conservatorship may be necessary. We guide families through the court process of appointing a conservator to protect the vulnerable individual’s best interests.

Hiring the Right Probate Administration Attorney

Choosing the right probate administration attorney is a critical decision. You need a trusted advisor who offers clear guidance and compassionate support. Here’s what to look for:

- Specialization and Experience: Does the attorney focus on probate and estate administration? An attorney who specializes in this area will understand the nuances of state laws in Arizona and Texas. Ask about their experience with cases similar to yours.

- Communication Style: Clear, consistent communication is paramount. The attorney should explain complex legal concepts in plain language and be responsive to your questions. Ask about their communication process and typical response times.

- Fee Structure: Understand how the attorney charges for their services upfront. Transparency about costs is essential.

- Case Strategy: A good attorney should be able to provide an initial assessment of your case, including a projected timeline and potential challenges.

- Trust and Comfort: You need to feel comfortable and confident in their ability to guide you. The initial consultation is your opportunity to interview them.

For more help, see our guide on Hiring a Probate Lawyer in 2026: What You Need to Know.

Costs and Fee Structures

Attorney fees are a common concern and are typically paid from the estate’s assets, not by the executor personally. Common structures include:

- Hourly Rates: Many attorneys charge an hourly rate that varies based on experience and location.

- Flat Fees: Some attorneys offer a flat fee for straightforward, uncontested cases.

- Percentage of the Estate: In some jurisdictions, fees may be a statutory percentage of the estate’s value.

Beyond attorney fees, expect other costs like court filing fees, appraisal fees, and publication costs for notifying creditors. We believe in complete transparency and will discuss all potential costs with you upfront. Learn more at How Much Does a Probate Lawyer Cost?.

The Consequences of Improper Probate

Attempting probate without legal guidance can lead to severe consequences that far outweigh the potential savings on attorney fees.

- Title Transfer Issues: Without proper court orders, real estate and other assets cannot be legally transferred, leaving heirs unable to sell or refinance property.

- Personal Liability for Executor: An executor has a fiduciary duty. Mistakes like paying heirs before creditors or missing tax deadlines can result in the executor being held personally liable for losses.

- Lingering Creditor Claims: Failure to properly notify creditors can lead to future lawsuits against the estate, even after assets have been distributed.

- Family Conflict: Without clear legal guidance, minor disagreements can escalate into costly litigation, especially when there is no will or family dynamics are complex.

- Legal Penalties: Non-compliance with court rules and deadlines can lead to fines, sanctions, or the removal of the personal representative, prolonging the process indefinitely.

Frequently Asked Questions about Probate Attorneys

We understand that probate can raise many questions. Here are answers to some of the most common inquiries.

Do all estates have to go through probate?

No. Whether an estate requires probate depends on the type, value, and titling of the deceased’s assets.

- Small Estate Exemptions: Both Arizona and Texas have simplified procedures for “small estates” that fall below a certain value threshold, allowing them to avoid formal probate.

- Non-Probate Assets: Assets with beneficiary designations (like life insurance or 401(k)s), property held in a living trust, or assets owned jointly with right of survivorship bypass probate and transfer directly to the new owner.

An attorney can assess the estate to determine if probate is necessary.

Can I handle probate without an attorney?

While legally possible for very simple, uncontested estates, it is generally not advisable. The process is filled with legal complexities, strict deadlines, and potential personal liability for the executor. An executor has a fiduciary duty, and mistakes can be costly. Hiring a probate administration attorney provides essential counsel, ensures compliance, and protects you from liability, leading to a more efficient process. For more guidance, see How Do I Know If I Need a Probate Lawyer?.

What happens if the executor lives in a different state?

It is common for an executor to live in a different state from where the probate is filed (e.g., an executor in California for a Texas probate). While this adds complexity, it is manageable.

- Out-of-State Executors: Most states, including Arizona and Texas, allow non-residents to serve as executors, though they may need to appoint an in-state agent for legal service.

- Ancillary Probate: If the deceased owned property in multiple states, a separate “ancillary probate” may be required in each state.

- Local Legal Counsel: It is highly advisable for an out-of-state executor to retain local legal counsel. We can handle court appearances and filings, ensuring compliance with local laws while keeping the executor fully informed.

Conclusion: Gaining Peace of Mind During a Difficult Time

The passing of a loved one is one of life’s most difficult experiences, and navigating the legal landscape of probate can feel overwhelming. A dedicated probate administration attorney serves as a crucial source of support and clarity.

Our role is to simplify this complex process. We provide expert guidance through every step, from validating wills and managing assets to settling debts and distributing inheritances. We protect the executor from personal liability, ensure fairness among beneficiaries, and work to resolve any disputes that arise.

At National Probate Partners, we offer experienced, personalized, and compassionate service to resolve probate challenges for families in Arizona, Texas, and across the U.S. We don’t just handle legal documents; we help you gain peace of mind.

Explore our expert probate lawyer services