Why “Avoid Probate CA” Matters for California Families

Avoid probate CA is a primary goal for many Californians planning their estates. Probate is the court-supervised process of transferring a deceased person’s assets to their heirs. In California, this process is notoriously slow, often taking 9 months to 2 years. It’s also expensive and public.

California’s statutory probate fees are calculated on the gross estate value. A $500,000 estate, for example, could face $13,000 in statutory fees alone, not including other costs. Beyond the financial drain, the time delay means your loved ones may wait years to access their inheritance, all while your family’s financial details become public record.

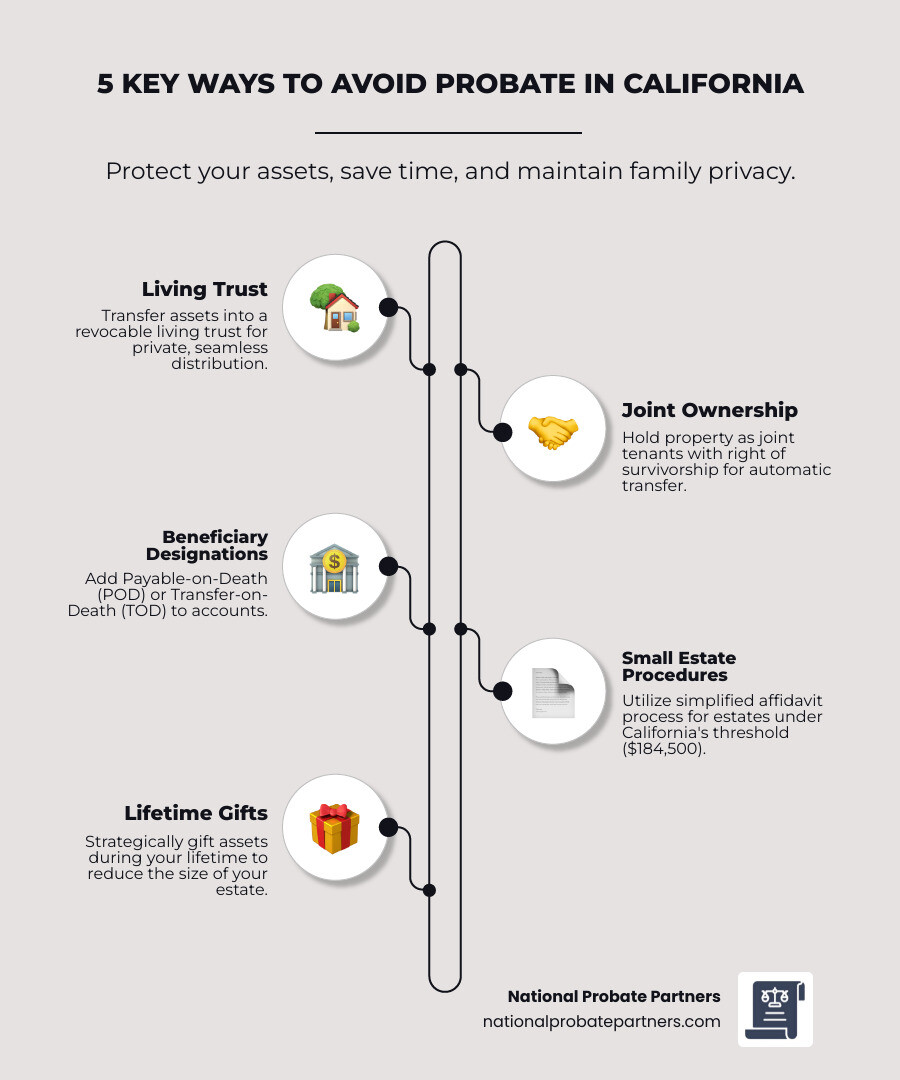

Fortunately, proper planning can help most California estates avoid formal probate. The top strategies include:

- Creating a Revocable Living Trust

- Using Joint Ownership with right of survivorship

- Naming beneficiaries with Payable-on-Death (POD) or Transfer-on-Death (TOD) designations

- Using Small Estate Procedures for estates under $184,500

- Gifting assets during your lifetime

This guide will walk you through these California-specific strategies to keep your estate out of court and ensure your assets are transferred smoothly to your beneficiaries.

Understanding California’s Probate Process

Before learning how to avoid probate CA, it’s helpful to understand what it is. Probate is the formal court process that validates a will, appoints an executor to manage the estate, settles debts and taxes, and distributes assets to the rightful heirs. It’s the legal mechanism for transferring a deceased person’s property.

In California, the probate court confirms a will’s validity or determines heirs if there is no will (intestacy). The court also grants the executor legal authority to gather assets, pay creditors, and file final tax returns.

A major concern is the cost. California’s statutory probate fees are based on the gross estate value, not the net value after debts. These fees apply to both the executor and the estate’s attorney. An estate valued at $500,000 could incur $13,000 in statutory fees, plus appraisal fees, court costs, and other expenses. For more details, see our guide on How Much Does a Probate Lawyer Cost?.

Another issue is privacy. Probate makes the will and estate details public record, exposing sensitive financial information. This lack of privacy is a key reason many families seek to avoid probate CA. You can learn more from the state’s Guide to wills, estates, and probate court.

Why People Want to Avoid Probate in California

The reasons to avoid probate CA are compelling:

- Time Delays: The process is lengthy, often taking 9 months to 2 years in California. During this time, assets are frozen, which can cause financial hardship for beneficiaries who are waiting for their inheritance.

- High Costs: Statutory fees for the executor and attorney are calculated on the gross value of the estate, significantly reducing the inheritance. A $500,000 estate could lose tens of thousands to fees and administrative costs.

- Loss of Privacy: All probate documents, including the will and asset inventories, become public record. Many people prefer to keep their family’s financial matters confidential. A properly funded trust, unlike a will, remains a private document.

- Potential for Family Disputes: The formal court setting and financial stakes can fuel disagreements among heirs. While probate offers a way to resolve disputes, avoiding the process can prevent many conflicts from arising. If you face such a situation, our team can help. Learn more about Probate Disputes: What You Need to Know From a Probate Lawyer.

Assets That Are Generally Exempt From Probate

Not all assets go through probate. Understanding which assets bypass the court is key to effective estate planning. The following assets are typically exempt from probate in California:

- Life Insurance Policies: Proceeds are paid directly to the named beneficiary.

- Retirement Accounts (401k, IRA): Funds are transferred directly to the designated beneficiaries.

- Assets in a Living Trust: The successor trustee distributes assets according to the trust’s terms without court oversight.

- Property Held in Joint Tenancy: Property with right of survivorship automatically passes to the surviving owner(s).

- Payable-on-Death (POD) Accounts: Bank account funds are paid directly to the POD beneficiary.

- Transfer-on-Death (TOD) Designations: Securities, vehicles, and even real estate (with a TOD deed) pass directly to the named beneficiary.

By using these tools, a large portion of an estate can be kept out of probate, saving time, money, and preserving privacy.

Key Strategies to Avoid Probate CA: A Checklist

To avoid probate CA, proactive strategies are essential to ensure your assets are distributed efficiently and privately. Here is a checklist of the primary methods:

- Create a Revocable Living Trust

- Use Joint Ownership with Right of Survivorship

- Use Payable-on-Death (POD) and Transfer-on-Death (TOD) Designations

- Gift Assets During Your Lifetime

Let’s explore these strategies in more detail.

Strategy 1: Create a Revocable Living Trust

A revocable living trust is the most comprehensive tool for bypassing probate. It’s a legal document where you (the grantor) transfer assets to yourself as the trustee. You name a successor trustee to manage the trust upon your death or incapacitation and designate beneficiaries to receive the assets.

Because the trust owns the assets, not you individually, there is nothing for the probate court to administer. Your successor trustee simply follows the trust’s instructions to distribute the assets. This process is private, faster, and less costly than probate.

For a trust to be effective, you must “fund” it by formally transferring asset ownership into the trust’s name. This critical step involves:

- Real Estate: Recording new deeds that title the property in the trust’s name.

- Bank & Investment Accounts: Retitling accounts at your financial institutions.

- Other Valuables: Transferring titles for personal property, business interests, etc.

During your lifetime, you retain full control over the assets and can amend or revoke the trust at any time. A major benefit is that if you become incapacitated, your successor trustee can manage your finances without needing a court-appointed conservatorship. To learn more, explore How Does a Revocable Trust Avoid Probate?.

Strategy 2: Use Joint Ownership with Right of Survivorship

Joint ownership with right of survivorship is another effective way to avoid probate CA for specific assets. When one owner dies, the property automatically passes to the surviving owner(s).

In California, this can be achieved through:

- Joint Tenancy with Right of Survivorship: Available to any two or more people, this form of ownership ensures the deceased’s share automatically transfers to the surviving joint tenants. See Cal. Civ. Code § 683.

- Community Property with Right of Survivorship: Exclusive to married couples and registered domestic partners in California, this combines community property tax benefits with the automatic transfer of ownership to the surviving spouse, avoiding probate. See Cal. Civ. Code § 682.1.

This differs from Tenancy in Common, where each owner’s share passes to their heirs via their will or intestacy, which usually requires probate. While joint ownership is simple, it gives the co-owner immediate rights to the asset, which can be risky. It’s wise to consult an attorney to see if this is the right strategy for you. If you’re unsure, we offer free consultations: Do You Really Need a Probate Lawyer? Contact Us for a Free Consultation!.

Strategy 3: Use Payable-on-Death (POD) and Transfer-on-Death (TOD) Designations

POD and TOD designations are simple ways to avoid probate CA for financial accounts and other property. You name a beneficiary who receives the asset directly upon your death, bypassing court.

- Payable-on-Death (POD) for Bank Accounts: Add a POD designation to checking or savings accounts. The beneficiary claims the funds directly from the bank with a death certificate.

- Transfer-on-Death (TOD) for Securities: Register stocks, bonds, and brokerage accounts in TOD form. The beneficiary inherits the account automatically.

- TOD for Vehicles: Register your vehicle with a TOD beneficiary at the DMV to ensure it passes outside of probate.

- California’s Transfer-on-Death Deeds for Real Estate: A TOD deed for real property, recorded during your lifetime, transfers the property to your beneficiary upon your death without probate. You retain full ownership rights, including the right to sell or revoke the deed, while you are alive.

California’s Small Estate Procedures

Even without a comprehensive plan, California law offers simplified processes for smaller estates, allowing them to bypass formal probate. These “summary succession” procedures are a key way to avoid probate CA when an estate’s value is below a certain threshold.

Eligibility depends on the total value of the decedent’s property. As of April 1, 2022, if the total value of the estate (excluding non-probate assets) is $184,500 or less, heirs may not need to go to Probate Court. This limit is adjusted for inflation every three years by the Judicial Council. The next update on April 1, 2025, will increase the limit to $208,850.

These adjustments keep the procedures relevant. For example, for deaths on or after April 1, 2025, the maximum value of a decedent’s main home that can be transferred via a simplified petition will rise to $750,000. To see if your family can use these procedures, you can Check if you can use a simple process to transfer property on the California Courts website. If the estate qualifies, it’s an excellent way to save time and money.

How to Use the Small Estate Affidavit to Avoid Probate CA

For qualifying estates, the Small Estate Affidavit (or Affidavit for Collection of Personal Property) is a powerful tool to avoid probate CA by allowing heirs to collect personal property without court.

Eligibility Requirements:

- Estate Value: The gross value of the decedent’s personal property in California must be $184,500 or less (for deaths between April 1, 2022, and March 31, 2025). This excludes non-probate assets like joint tenancy property, trust assets, and accounts with beneficiaries.

- Waiting Period: At least 40 days must have passed since the death.

- No Probate Case: No formal probate proceeding can be open or have been granted.

- Claimant: The person claiming the property must be the legal heir or beneficiary.

The Process:

To use the affidavit, you first calculate the estate’s value, including only probate assets. After the 40-day waiting period, the heir(s) must complete the specific affidavit form, listing the assets and affirming under penalty of perjury that the estate qualifies. The form must be signed by all heirs and notarized. Finally, present the notarized affidavit to the institutions holding the assets (like banks or brokerage firms), which are then required to release the property. While this process is simpler than formal probate, attention to detail is crucial for it to be successful.

Frequently Asked Questions about Avoiding Probate

Navigating estate planning to avoid probate CA can bring up many questions. Here are answers to some common inquiries.

Does having a will help me avoid probate in California?

No. This is a common misconception. A will does not avoid probate; in fact, it is the primary document submitted to the probate court. A will provides instructions for the court to follow, such as naming your executor and beneficiaries. For these instructions to be legally enforced, the will must be validated by the court through the probate process.

While a will is a vital part of an estate plan, it does not bypass the court system. If your probate-eligible assets exceed California’s small estate threshold (currently $184,500), a formal probate proceeding will likely be necessary, even with a will. To truly avoid probate, you need other tools like a living trust or beneficiary designations. For help determining your needs, see How Do I Know If I Need a Probate Lawyer?.

What are the risks of probate avoidance strategies?

While beneficial, probate avoidance strategies have potential downsides that require careful consideration.

- Joint Ownership Risks: Adding a joint owner gives them immediate ownership rights. This means you lose sole control, and the asset becomes vulnerable to the other owner’s creditors, lawsuits, or divorce. It can also lead to unintended inheritance outcomes and tax complications.

- Loss of Control from Gifting: Gifting assets is irrevocable. You lose all control over the asset, which can be problematic if your financial situation changes. Large gifts may also trigger federal gift tax rules.

- Improperly Funded Trusts: A living trust only avoids probate for assets formally transferred into it. If you create a trust but fail to “fund” it by retitling assets, those assets will still go through probate.

- Creditor Claims: A revocable living trust does not protect assets from your own creditors during your lifetime. Since you retain control, creditors can generally access trust assets.

Given these risks, consulting with an experienced estate planning attorney is crucial to ensure your strategies align with your goals and don’t create unintended problems.

When might probate still be necessary?

Even with careful planning to avoid probate CA, the process may still be required in certain situations.

- Assets Left Out of a Trust: Any assets not properly funded into a living trust that exceed the small estate limit will likely require probate.

- Significant Creditor Issues: Probate provides a formal, court-supervised process for handling complex creditor claims, which can protect the executor and heirs from future liability.

- Disputes Among Heirs: If there is a will contest or other family dispute, the probate court provides the legal forum for a binding resolution.

- No Beneficiary Named: If an asset that normally bypasses probate (like a 401(k) or life insurance policy) has no living beneficiary named, it will revert to the estate and likely go through probate.

- Clearing Title to Property: In some cases, a court order from probate is needed to establish a clear, marketable title for real estate, especially if ownership history is ambiguous.

- Estate Exceeds “Small Estate” Limits: If an estate’s value is over the threshold for simplified procedures and no other avoidance strategies are in place, formal probate is the default process.

Secure Your Legacy Beyond Probate

The journey to avoid probate CA is an act of foresight for your loved ones. By implementing strategies like creating a revocable living trust, using joint ownership, and naming beneficiaries, you can streamline the transfer of your legacy.

Proactive planning spares your family the financial burdens, stress, and public exposure of California’s probate process. It ensures your assets reach your beneficiaries quickly and privately, providing clarity during a difficult time.

While DIY options exist, estate planning laws are complex. A misstep can undo your efforts to avoid probate. Our team at National Probate Partners specializes in helping families in California, Arizona, Texas, and across the U.S. steer these complexities. We provide experienced, compassionate service to resolve probate challenges and help you create a solid plan for the future.

Don’t leave your family’s future to chance. Take the proactive step to secure your legacy and ensure a smoother transition for your loved ones.

Contact us to start your estate plan today, and let us help you build a plan that protects your family’s peace of mind.